By Jessica Duncan

This month Competiscan checked in with consumers to gauge the confidence they had with their current finances and to hear what was most important to them in achieving greater financial health. Hundreds of consumers from Competiscan’s panel responded to the survey, representing all age ranges and employment status from students, full-time employees, unemployed, and retirees. We learned there were several key priorities with their financial management that rose to the top. Consumers showed a desire to improve areas in their financial lives like reducing debt and increasing savings. Notably more than half of the respondents had yet to tap into resources or tools provided by financial partners or independent services, with many expressing they felt equipped to navigate it on their own. While one could interpret this as a limited audience of interest, this also could indicate that a population of consumers currently exists that do not realize their journeys could be made easier or improve with the right targeted tools.

Is Financial Stress Affecting Your Work, Health, or Relationships?

Financial well-being is often intertwined with a consumer’s physical and mental health, 39% responded that financial stress was affecting other areas of their lives. When asked if the pandemic negatively impacted their finances, 37% also said Yes. The connection that finances play in a consumer’s livelihood led to the quick response observed by companies during the pandemic with offerings like grace periods and forbearance. Importantly, we also observed recognition of the greater impact to one’s health, as displayed by examples like American Express granting complimentary access to apps like Calm.

While special account assistance has mostly subsided, the approach has evolved, indicating that financial institutions are placing a greater emphasis on finding ways to offer holistic financial support. This tactic shows an effort to build stronger relationships and a deeper shift to a customer-centric service model. In an email campaign promoting their new Money & Life Program, Capital One addressed the ability to help customers identify financial stressors and assist in tackling them through one-on-one sessions, self-guided exercises, videos on demand, or workshops.

What Are Your Top Financial Goals or Concerns?

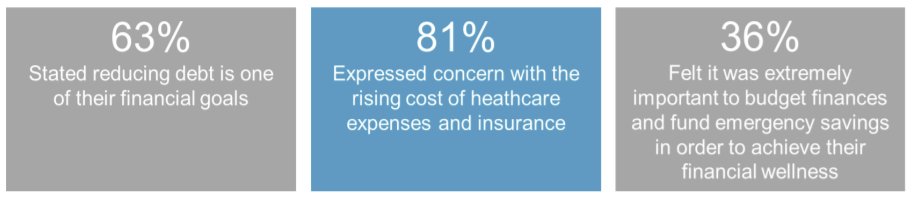

Reducing debt, budgeting, and saving-based tools are three common solutions that companies focus on to assist consumers with their financial journey. Our respondents confirmed these align with their areas of interest, but are financial institutions and other independent service providers missing the largest area of communicated need? Over 80% agreed that they are concerned with rising costs in healthcare and insurance expenses, and this is a stat that is hard to overlook. Interestingly, there were nearly as many respondents that agreed with this statement that were under the age of 55, as there were that were 55 or older. This could become a niche area of focus for companies looking to show that their support truly

encompasses all areas of financial concern.

Who Would You Turn to for Support?

The responses to this question were dispersed across the available survey options with bank/credit union and retirement plan provider capturing the highest marks from the different financial service providers presented. Others that were listed as options included their lender, card issuer, insurance provider, or employer. Personal budget and credit health software/apps also represented a top share of responses.

Interestingly, the largest segment, representing 35% of the total, stated that they would not turn to any of the listed providers for support. This could speak to perceptions of feeling adequate in the ability to manage their finances on their own, or a lack of awareness to the tools and resources that are currently available and how they could be utilized.

There is also an important perception to consider that many consumers are not willing to pay for financial wellness assistance. This supports the direction that Competiscan has observed companies taking by providing financial wellness tools as a complimentary or value-add service.

What Matters Most?

Consumers reported that they value trust as the top influencer when deciding who they would choose to help manage their financial health. This topped other options like ease of use, expertise, and innovation.

When presented with different types of financial wellness tools, respondents showed the highest likelihood to leverage credit score monitoring and the lowest likelihood to participate in educational events or live webinars. Credit score monitoring has become table stakes within the industry and the level of comfort reported with this service has likely been influenced by repeat exposure; giving consumers the ability to associate this as a free service offered by many. Other top selections included interactive online tools and automatic savings features, suggesting a desire by consumers to engage with the solutions at their pace and on their time.

In closing, the respondents were able to share their opinion on what financial wellness means to them, and a recurring sentiment was the ability to elevate the “worry” from financial aspects of their life – for some that involved no longer having to choose which payment to make, while for others it meant having a sizable nest egg by retirement. Despite lower reported levels of engagement with existing tools, many consumers have a vested interest in improving their financial well-being. It is important to remember that solutions to help them on their journey can be more than the dedicated wellness programs, for instance raising awareness to account alert features, savings opportunities, and automated payments. These too are tools that can help consumers alleviate some “worry” from their everyday finances.

Consistently highlighting these turn-key options and making them available through self-serve channels like online or the mobile app will appeal to today’s preferred method of engagement and can quickly show consumers the impact these services can make, opening the door for deeper partnership.

Clients, Be on the lookout for our complete Insights Study which will cover these financial wellness

topics and much more!

For more information on marketing trends, Competiscan clients can view our archive of reports and insights online.

Not a client? Sign up for a demo today.